27+ bull put spread calculator

Ad Smart Options Strategies shows how to safely trade options on a shoestring budget. Web Bull Call Spread Calculator Search a symbol to visualize the potential profit and loss for a bull call spread option strategy.

Credit Spread Calculator Incometrader Com

Web Now if a bull put spread calculator is the best way to figure out how much you should be saving by selling a house right now then the calculator should have a lot.

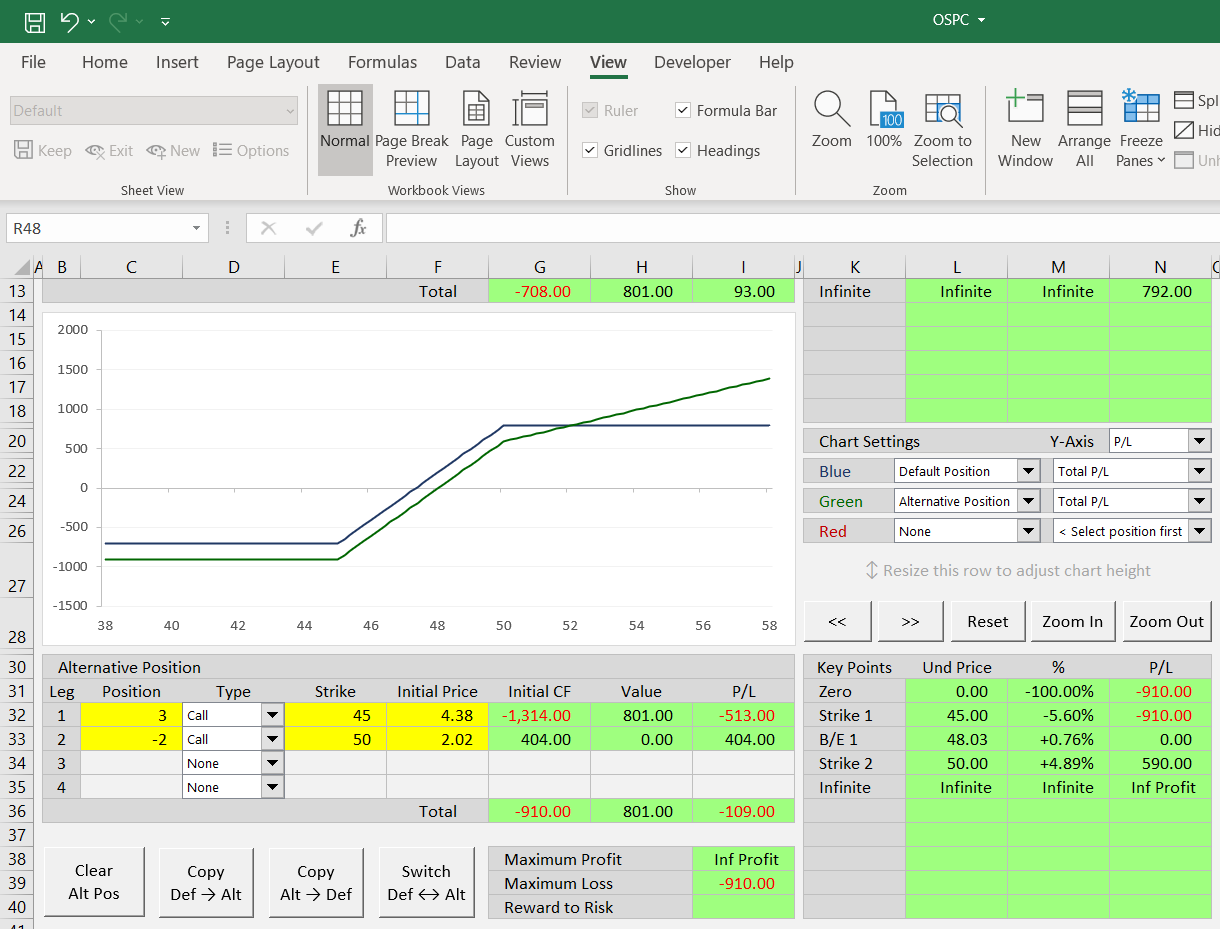

. Enter the maturity in days of the strategy. Web Bull put spreads are also known as put credit spreads because they collect a credit when the trade is entered. Web The Bull Put Calculator can be used to chart theoretical profit and loss PL for bull put positions.

Web According to our bull put spread calculator we will have to pay 23 for the contract we buy while we will receive 114 for the contract we sell. Clicking on the chart icon on the Bull Call Screener Bull Put Screener loads. Maximum Annual Percent Return Available as a.

What is a bull put spread. Enter the underlying asset price and risk free rate. Bullish Limited Profit Limited.

Web Given this we can generalize the Bull Put Spread to identify the Max loss and Max profit levels as Bull PUT Spread Max loss Spread Net Credit Net Credit. Web The Bull Put Calculator can be used to chart theoretical profit and loss PL for bull put positions. Web Post date October 27 2021.

Web A bull put spread involves being short a put option and long another put option with the same expiration but with a lower strike. Trading with the trend involves. Specifically it involved a bull call.

There are two trading methodologies for placing bull put spreads trading with the trend and swing trading. Lets model an example bull call spread with the. Probability of the underlying expiring at or below the long put strike at expiration.

The risk is limited to the width of the spread minus the. Select your option strategy type Call Spread or Put Spread Step 2. Web Bull Put Spread Calculator Search a symbol to visualize the potential profit and loss for a bull put spread option strategy.

Download Smart Options Strategies free today to see how to safely trade options. Ad Options expert shows the trading strategy his students use to become profitable traders. What is a bull call spread.

Strike IVol Price Volume Strike IVol Price. Web A bull put spread is a variation of the popular put writing strategy in which an options investor writes a put on a stock to collect premium income and perhaps buy. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market.

Web A bull call spread position consists of two call options one long call with lower strike and one short call with higher strike. Therefore the bull put credit. You could make steady income per trade by making this simple trade 3-5xs a Week.

Web Bull Put Spread Max Risk. Web Download the Bull Put Spread Calculator. Bullish Limited Profit Limited.

Web Long Put Short Put Credit Spread Spread Ratio Net IVol. The short put generates income whereas the.

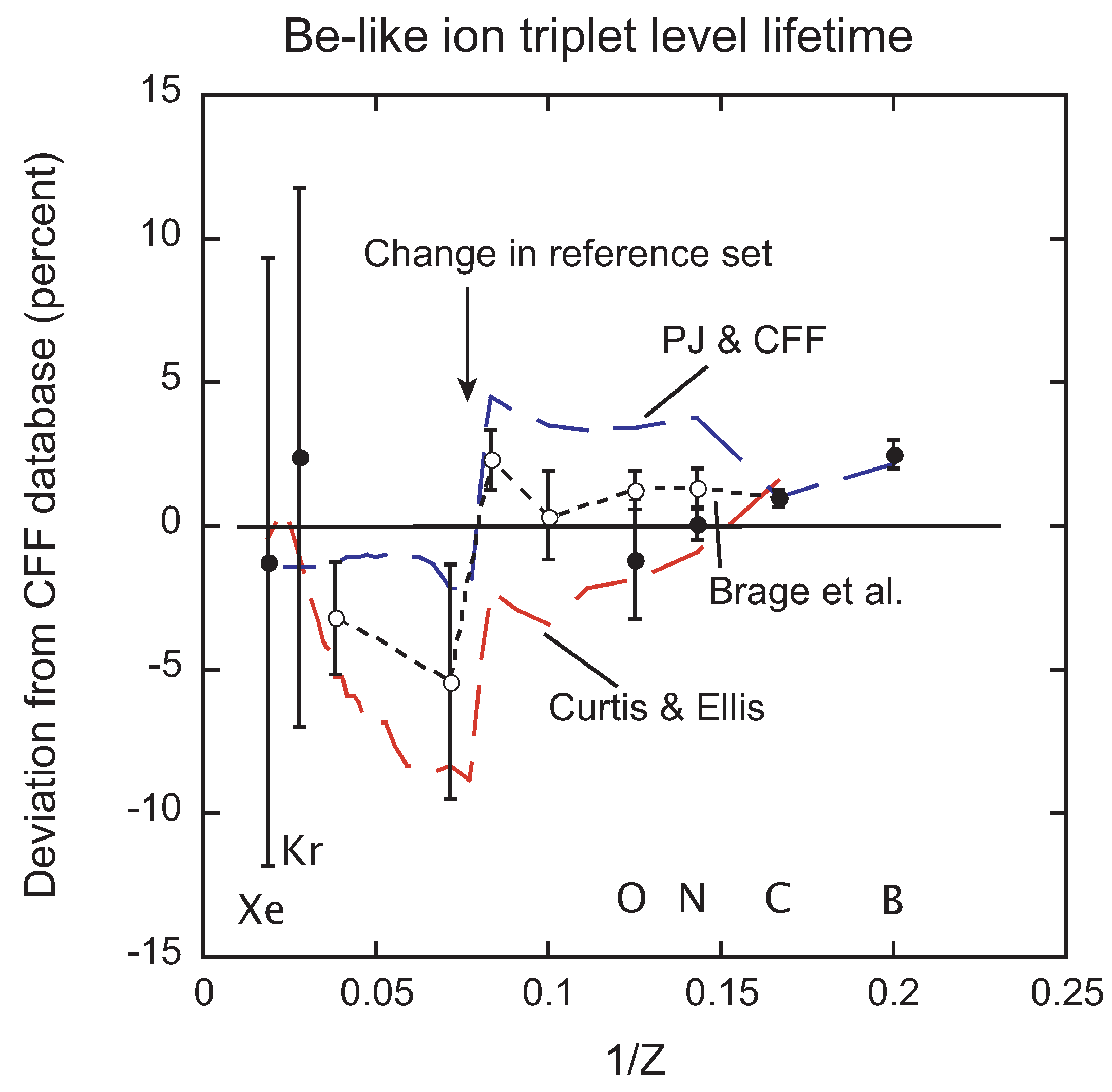

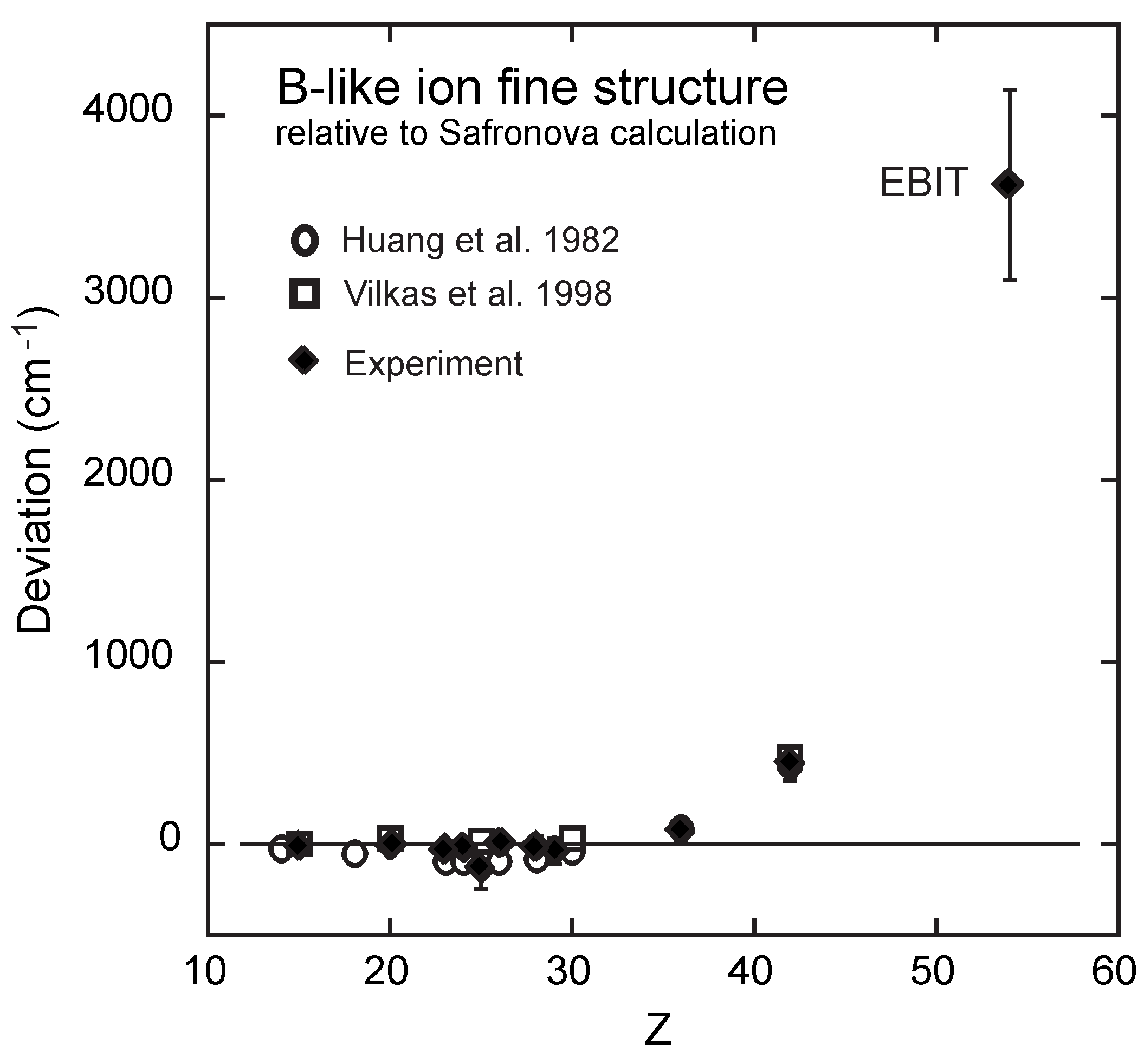

Atoms Free Full Text Critical Assessment Of Theoretical Calculations Of Atomic Structure And Transition Probabilities An Experimenter S View

Accounts Receivable Formula Excel Template Based Examples

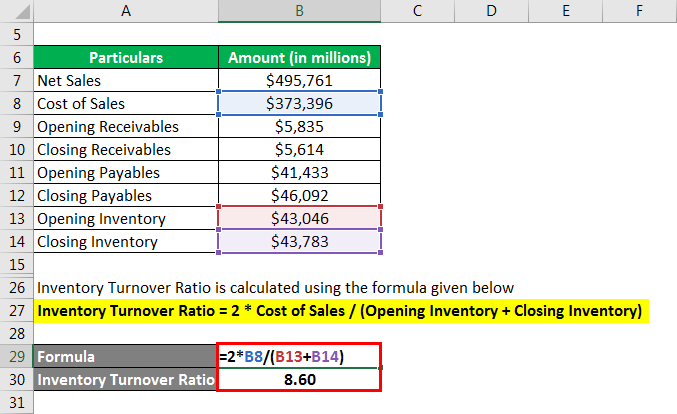

Turnover Ratios Example Explanation With Excel Template

Bull Put Spread Calculator 2020 Update

Loss Ratio Example And Explanation With Excel Template

Bull Put Spread Profit Calculation Option Alpha

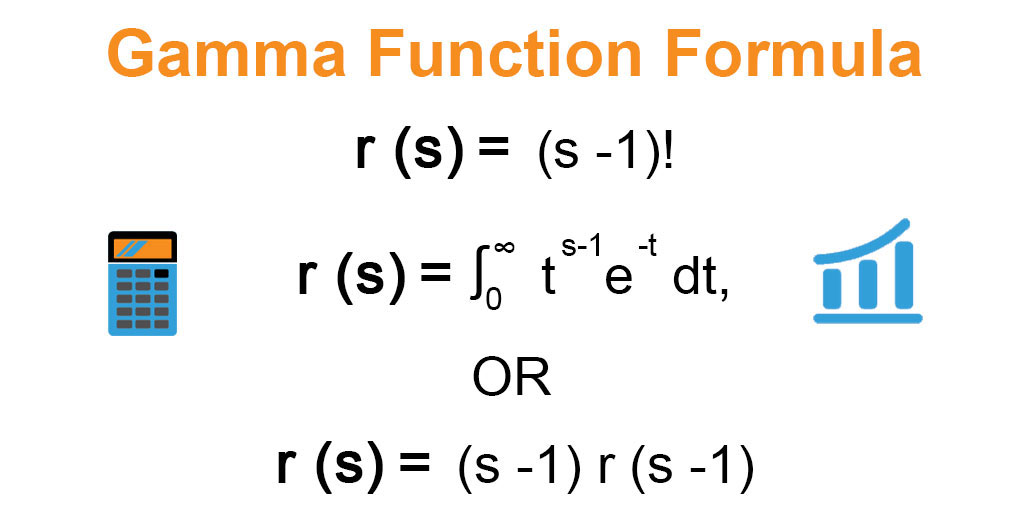

Gamma Function Formula Example With Explanation

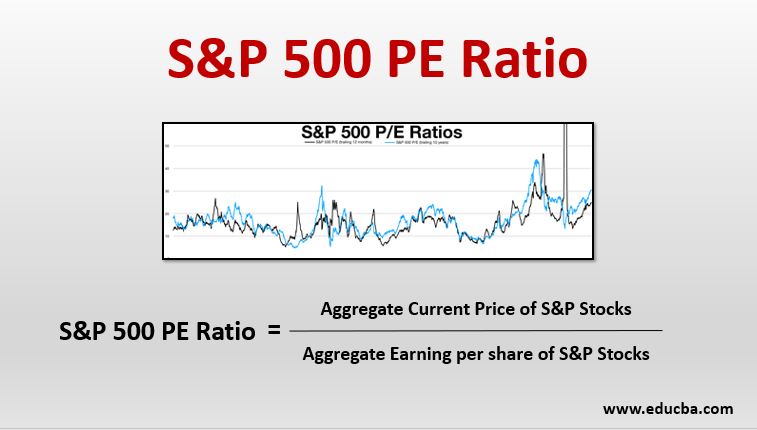

S P 500 Pe Ratio Idea To How The Stock Market Is Performing And Based

Atoms Free Full Text Critical Assessment Of Theoretical Calculations Of Atomic Structure And Transition Probabilities An Experimenter S View

Medium Term Note How Does Medium Term Note Work With Examples

Options Spread Calculator

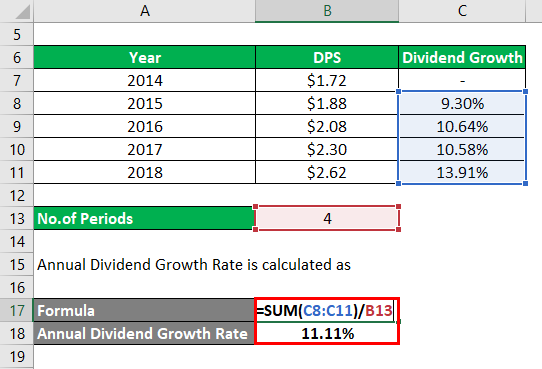

Dividend Growth Rate How To Calculate Dividend Growth Rate

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

Bull Put Spread Calculator Youtube

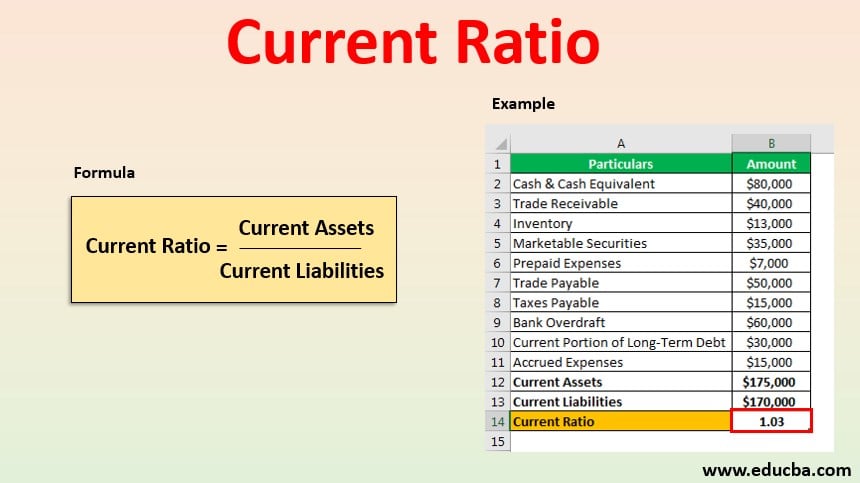

Current Ratio Examples Of Current Ratio With Excel Template

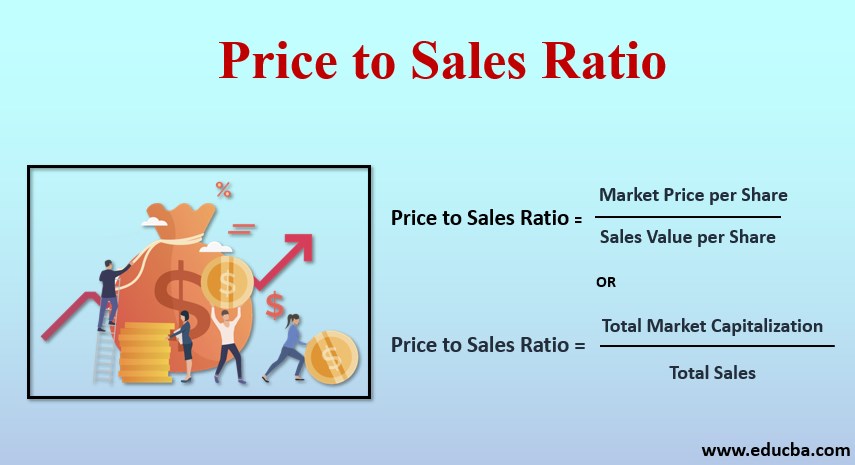

Price To Sales Ratio How To Calculate Price To Sales Ratio Examples

Bull Call Spread Option Strategy Payoff Calculator Macroption